Why renters are being doubly screwed

By creating the housing crisis in the UK, the Bank of England has not only made housing unaffordable to many people, it has also trapped many into renting a home when they otherwise would have been able to buy.

The rental market is particularly brutal for renters because to fund the house price inflation circle and keep house prices unaffordable, the Bank of England has to confiscate all rises in wages and more in real terms

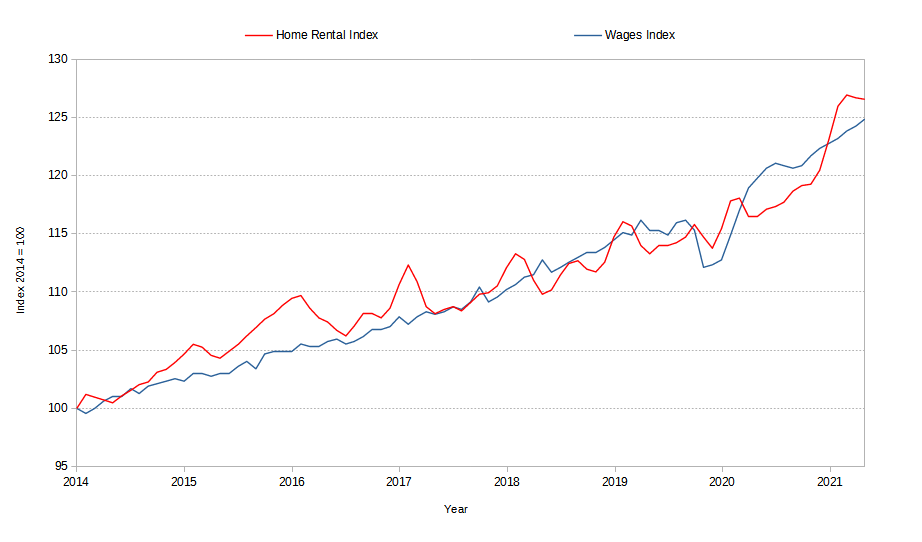

The wage-rental inflation race

This confiscation manifests itself in the wage-rental inflation race, as seen in the chart below. As the Bank of England debases the currency to create inflation, house prices rise and landlords demand higher rental incomes, which leads to people demanding higher wages.

Rents vs Wages, 2014 to 2021. Data from the Homelet Rental Index

and

Office for National Statistics

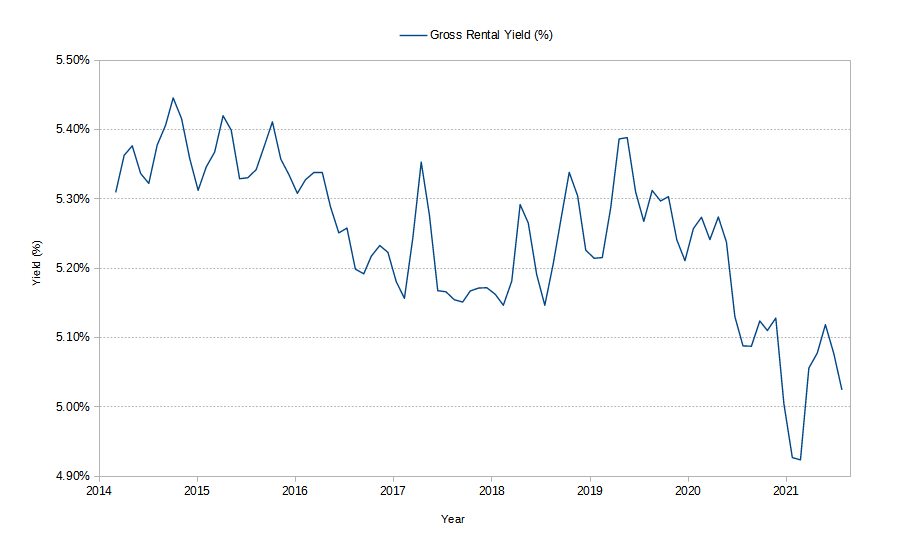

Although landlords are compensated for the inflation the Bank of England reports, they aren't fully compensated for the total inflation the Bank of England creates because rental prices are restricted by how much people can earn, and real wages are declining along with rental incomes (shown in the chart below). However, landlords benefit from the inflation in house prices that makes up a large part of the asset price inflation the Bank of England creates.

Gross Rental Yields, 2014 to 2021. Data from the Homelet Rental Index

and the

Nationwide Building Society

Making Britain feudal again.

As house prices rise, so do deposit requirements for those saving to buy a house. However, since wage increases are already being soaked up by rental increases (along with the price rises of everything else), it isn't possible for renters to save more than they are. On top of this, the wealth people have in their savings is being confiscated by the Bank of England's financial repression program. Eventually, many savers are completely priced out from being able to buy a home and end up being trapped into renting.

The corollary of this is that renters are being doubly screwed because they are effectively working to fund the Bank of England's unaffordable housing policy that keeps them trapped into renting.