30 April 2024

Bank of England screws the people with QE Losses

As if having 25% of their earnings and savings stolen in three years wasn't enough, the people of the United Kingdom are now having to pay for the privilege of being screwed with double-digit inflation by the Bank of England, by having to cover the bank's losses on its counterfeiting scam it euphemistically calls Quantitative Easing or QE for short, and which sole purpose is to help debase the currency and create inflation.

Losses are running at around £40 billion a year at present, and are mainly a result of the interest the Bank of England has to pay commercial banks on the money created by the scam, most of which is held on deposit at the Bank of England. Losses are inevitable and could amount to £100s of billions over the coming years.

Reserves move from bank to bank as people transfer money to each other, and therefore remain as deposits at the Bank of England unless they are withdrawn as cash, or unless the Bank of England removes them by selling bonds in a process it calls Quantitative Tightening (QT, the reverse of QE).

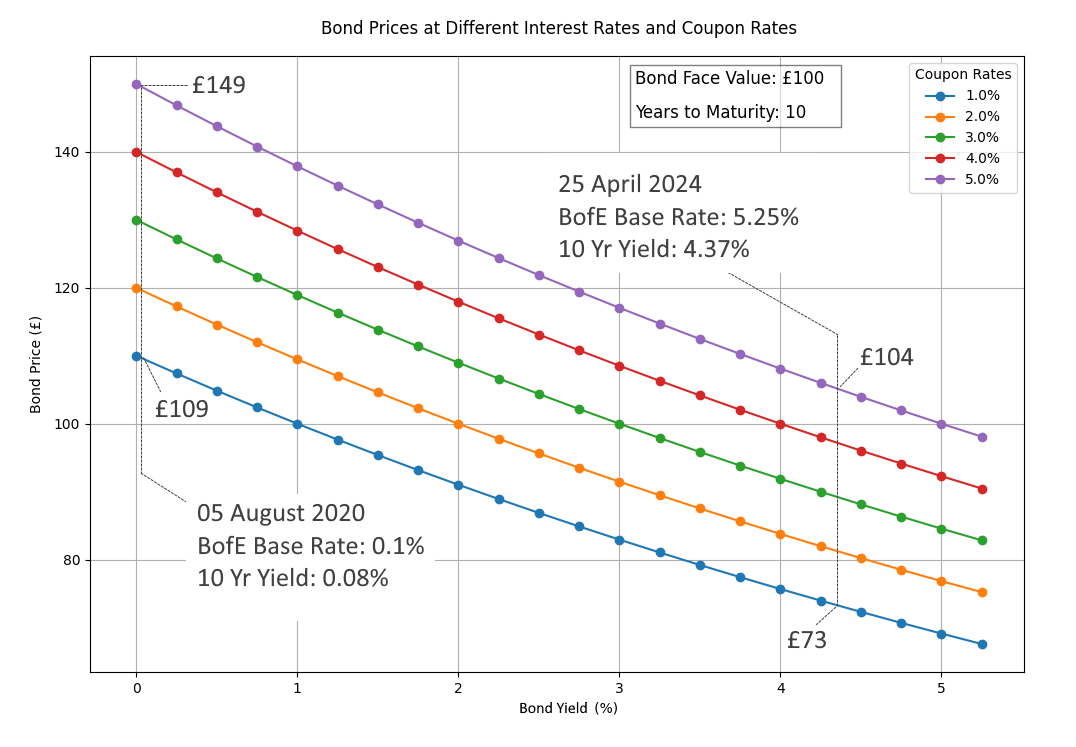

Bond prices at different interest rates. For a 10-Year £100 UK Bond.

The bank purchased the bonds when it had base rates held artificially low, hence forcing the taxpayer to overpay for them (since the Bank of England is owned solely by the UK Treasury, and hence taxpayer). For example, as seen in the figure above, a 10 year £100 bond yielding 5% a year would have been priced at £149 in August 2020 when the Bank of England had base rates at 0.1%. The same bond is now only £104. Similarly, a 10 year £100 bond yielding 1% a year would have been priced at £109 but is now only £73. Bonds of all rates and maturities purchased by the Bank of England in 2020 would have fallen in price, as well as many bonds purchased prior.

The Bank of England has four choices :-

- Sell the bonds at a loss.

- Hold on to the bonds and pay banks the current 5.25% interest rate on their reserves.

- Lower the base rate and, hence, interest rate paid on reserves.

- Lower or remove interest paid on reserves only.

Both the last two options would involve loosening monetary policy and causing even more inflation pain for the people of the United Kingdom. Simply lowering or removing interest paid on reserves would cause reserves to flee as banks sought a higher rate of return in the higher interest rate environment (relative to the interest rate being paid on reserves).

Although the Bank of England can enforce reserve requirements, it cannot really do this without paying interest at the base rate since it would result in bank losses. The amount of reserves created from QE is so huge (£793bn as of April 2024), reserve requirements would have to be huge too, and, since banks still have to pay interest to depositors to stop them withdrawing their money, banks would incur significant losses which could lead to them needing a public bail out once again.

Whatever the Bank of England chooses, the people of the United Kingdom lose. Losses to the public were guaranteed as soon as the Bank of England embarked on QE.