How inflation is created

People today have been conditioned to associate the term "inflation" with rising prices. But prices don't inflate—the money supply does. This perversion in meaning is a classic case of Orwellian language manipulation, where a concept is distorted for political and ideological purposes. Governments, central banks and much of the media portray inflation as something central banks fight. In reality, inflation is something central banks create.

In the UK, the Bank of England is solely responsible for all inflations of the pound sterling money supply and the consequent loss in purchasing power. It inflates the money supply by artificially suppressing borrowing costs and by effectively counterfeiting money. This encourages people and businesses to increase the amount they borrow, and pay more for things.

Suppressing interest rates increases lending

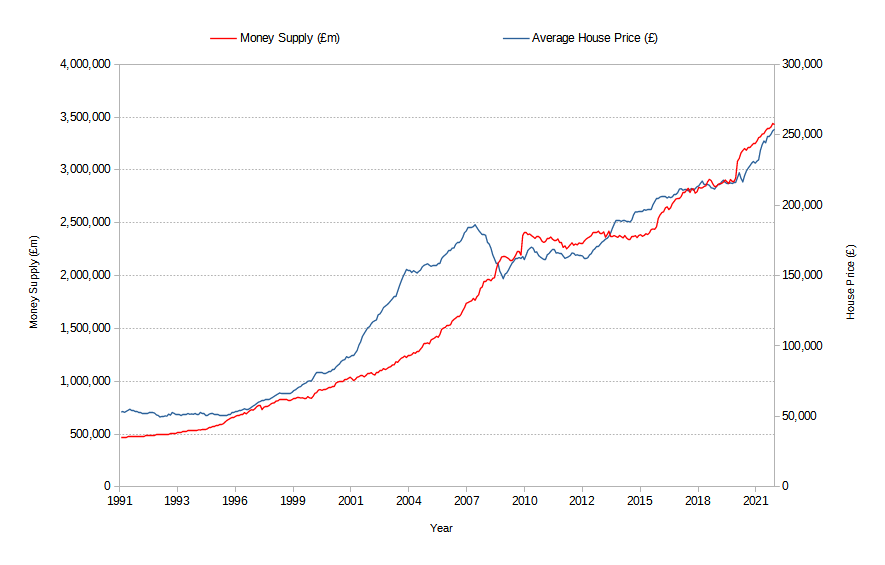

An immediate effect of suppressing interest rates and counterfeiting money is on house prices. When people are able to borrow more, they bid up the prices paid for housing and other residential property. This is shown in the chart below where rising house prices are contrasted with the inflating money supply.

Average House Price vs Money Supply. Data from the

Nationwide Building Society

and the

Bank of England

Increased lending increases the money supply

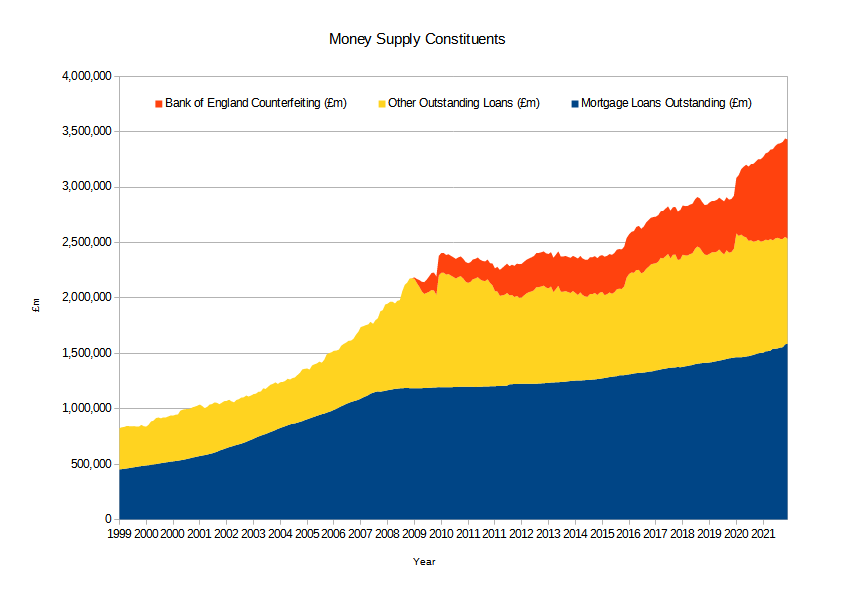

Because money is created through bank lending, a big part of the increase in money supply comes from this newly created mortgage lending. The chart below shows the money supply broken down into residential mortgage loans outstanding, other loans outstanding (which includes all other personal and corporate bank loans) and the Bank of England's counterfeiting.

Money Supply Breakdown, 1999 to 2021. Data from the

Building Society Association

and the Bank of England:

Counterfeiting,

Money Supply

Inflating the money supply causes prices to rise

The new money created from borrowing now has to find a purpose in the economy, and because most of it can't, it simply goes into chasing up the price of housing, goods and services.