How money is created

As with inflation, people today have been conditioned to pay no attention to what money is, how it is created and who creates it. Money used in any economy has to be created, and in the UK that responsibility lies with the Bank of England.

About 10% of the money supply is created in the form of notes, coins and bank reserves. This is referred to as base money or the monetary base, and is manipulated along with base rates to control the overall amount of money and its value in the economy. The remaining 90% gets created in the commercial banking system as bank deposits. This larger percentage reflects the preference for cashless transactions. There is virtually no limit to how much fiat money can be created.

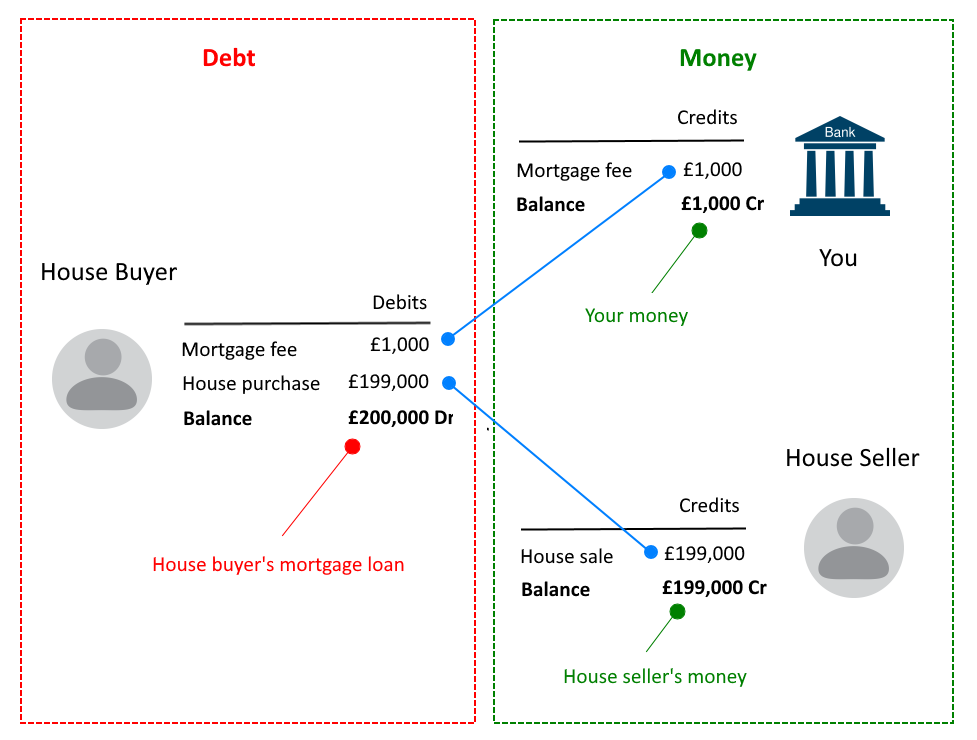

To get an idea of how bank deposits are created, imagine you own a bank and a creditworthy customer applies for a mortgage loan of £199,000 to buy a house. You charge them a £1,000 fee for setting up the loan, which is bundled in with the mortgage loan.

The image below illustrates how you would set up and record this transaction at your bank.

An example mortgage loan origination at your bank.*

* You may have noticed DR and CR on your bank statement. These are shorthand for debit and credit respectively.

An increase in deposits means new money

After setting up this transaction, you will have created £200,000 of new money—all else being equal—since the total amount of deposits in the banking system has now increased by £200,000. Commercial bank money exists only on ledgers at banks, and can also be thought of as digital or electronic money.

No physical money has actually exchanged hands in setting up this transaction. You have created debit and credit entries on the accounts of the house buyer, the house seller and yours, and these account entries add up to zero because

£199,000 (Credit) + £1,000 (Credit) - £200,000 (Debit) = 0.

Therefore, you haven't created any wealth or any value by carrying out these ledger entries. Creating money does not create wealth—something you may have heard many times before.

What about savers?

We are used to thinking of banks lending out the money of savers—and this does happen—although, banks can lend knowing they are able to fund that lending afterwards. Banks only have to cover transfers out to other banks, and since deposits also get transferred in, not all outgoing deposits require complete funding. Banks only have to settle the difference.

Without the demand for money or to hold money as deposits or savings, the speed at which money circulates would be a lot greater, and this could potentially lead to hyperinflation. Depositors and savers support the value of money, and are a crucial part of the monetary system.

Money as an IOU

Although money itself is not an IOU, commercial bank money replaces what would otherwise have had to have been an IOU (I Owe yoU) between the buyer and seller in the house purchase example. The use of bank money eliminates this need for direct trust between the two parties, and provides immediate payment to the seller.

The money in bank deposits is sometimes referred to as credit money. But this can cause confusion since credit and bank credit also refer to loans, overdrafts and other types of bank lending. Credit money is created from bank lending or bank credit, but it is really just an alternative to cash in a fiat system. And since deposits can be withdrawn as cash, total bank credit does not necessarily equal total bank deposits.