November 2024 Newsletter

November 2024 Newsletter

In this month's newsletter: Accounting doesn't create money. See below or view the article in your browser.

Dear Readers,

As central banks continue confiscating the public's earnings and savings to feed the bubbles, the Trump bump has helped catapult stock and crypto ones to new euphoric highs. The public no longer gets to decide where its income goes. It's all decided by central banks.

So much for tightening, the purpose of which was—or should have been—to contract the money supply. Both the UK and US M2 readings are nearing their pandemic peaks again (£3tr respectively & $21tr). The looting by central banks during the pandemic is being fully locked in.

Although money did get destroyed for a period after tightening started—as seen by the contraction of the money supply—this didn't last long. Because the money supply is now expanding, no more money is being destroyed. This may be at odds with the belief that money is being created and destroyed all the time. So which is right? This is looked at below.

Background

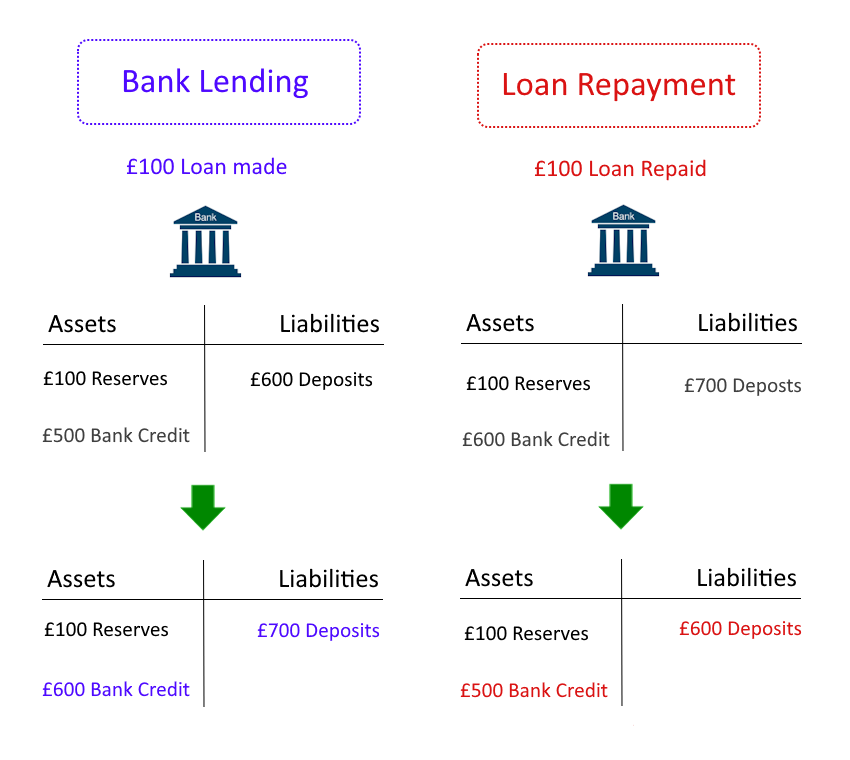

The belief that money is created when someone borrows and is destroyed when it is paid back arises from observations of the accounting entries used by banks. When a bank lends, it marks up numbers in someone's bank account, and when it is paid back, the numbers are marked down. This is depicted in Figure 1 below.

Figure 1. Example of Bank Lending and Loan Repayment.

Since bank deposits are part of the money supply, and deposit accounts are continuously being marked up and down due to lending and repayments, money must be continuously being created and destroyed.

Problems With This View

The issue with this view is that it overlooks how money functions in the economy as a vehicle for saving and lending. Notably:

- Deposits exist and circulate long after the loans that created them have been paid back. Over 80% of Brits save money and add to their savings every month. They aren't continuously paying back debt with them and resaving.

- Although banks are money creators, they do also function as intermediaries. Banks attract savers by offering competitive interest rates. When you move your savings, they are being lent out. No money is being created or destroyed.

Accounting Entries Don't Create Money

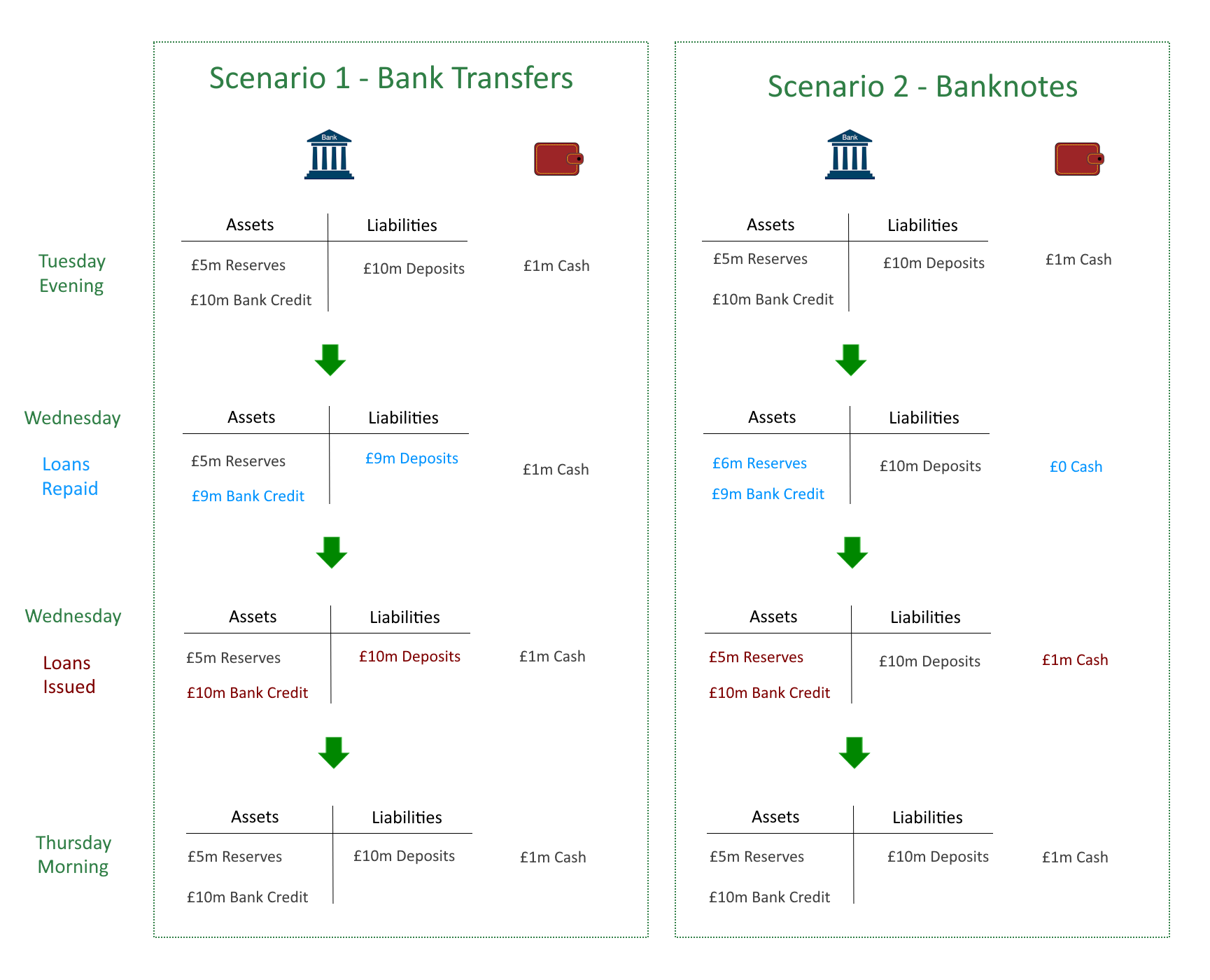

To highlight why it isn't the accounting entries that create and destroy money, imagine during a day's trading, say Wednesday, banks receive £1m in loan repayments and lend out £1m.

- In the first scenario, all money received and lent out is via bank transfers.

- In the second scenario, all money received and lent out is in banknotes.

The two scenarios are compared in Figure 2 below.

Figure 2. Two Scenarios Involving Bank Lending and Repayments During a Trading Day*.

* Starting balances and cash in circulation are made up for simplicity. Interest is ignored.

According to the belief, in the first scenario, £1m of money got destroyed and £1m of money got created, but not in the second scenario. Yet the accounting entries for both are virtually the same. In both scenarios, all bank accounts and balance sheets were the same on the Tuesday night before Wednesday's trading, and were the same on the Thursday morning after.

For the belief to be correct, you would have to argue that preferring to use bank deposits over cash somehow results in money being created and destroyed, which is a bit absurd. Handing over cash to a bank to pay a loan instalment doesn't destroy money either. The money is briefly taken out of circulation before being passed on to another customer.

Therefore, money does not get created and destroyed by accounting entries. Money creation is separate to the accounting of it. Money could be accounted for incorrectly, and this wouldn't create or destroy money either.

Money Creation

Just as accounting entries don't create profit, accounting entries don't create money either. Accounting records the movement of money as it flows and exchanges hands throughout the economy, creating both profits and new money, and sometimes their destruction.

New money is created incrementally, but most of the money created is recycled. It gets created by the banking system as a whole and not by individual banks. Banks grow or shrink their assets or liabilities depending on balance sheet capacities. If the overall money supply increases then you know new money has been created, and if the overall money supply shrinks then you know money has been destroyed.

Discussion

Let me know what you think by commenting on X or by emailing me. To comment or discuss, please reply to my X post containing the link to this article, or email me.