October 2024 Newsletter

October 2024 Newsletter

In this month's newsletter: Why Fiat Money is not an IOU. See below or view the article in your browser.

Dear Readers,

We live in a world of dishonest money where governments and their central banks rob people of their earnings and savings at will. In the past, these periods ended in economic turmoil and a return to honest, sound money.

As history repeats, many people are unaware how dishonest our money is. Some haven't thought about it, whilst some that have think money is backed by debt. Money being backed by something gives people the belief that it has value and scarcity. But is fiat money backed by anything? Is money an IOU (I owe you)? The short answer to both is no. The longer answer is below.

History

As the name implies, the pound sterling was once a weight of silver, but by the 19th century, the currency of the same name had become backed by gold. The paper money widely in use by then was an IOU for the gold that was held in central bank vaults.

Once gold-backing was abandoned for good in the 20th century, money stopped being an IOU. As the Bank of England states on its website (shown below in Figure 1), notes are no longer exchangeable for gold. They are no longer IOUs.

Figure 1. Bank of England Extract Stating Banknotes are No Longer IOUs.

You can exchange a £5 note for another £5 note, or a £10 note for another £10 note, but that's all, and that doesn't make notes IOUs. Notes are not liabilities for anything. As a holder, you are not owed anything.

Fiat Money as Debt

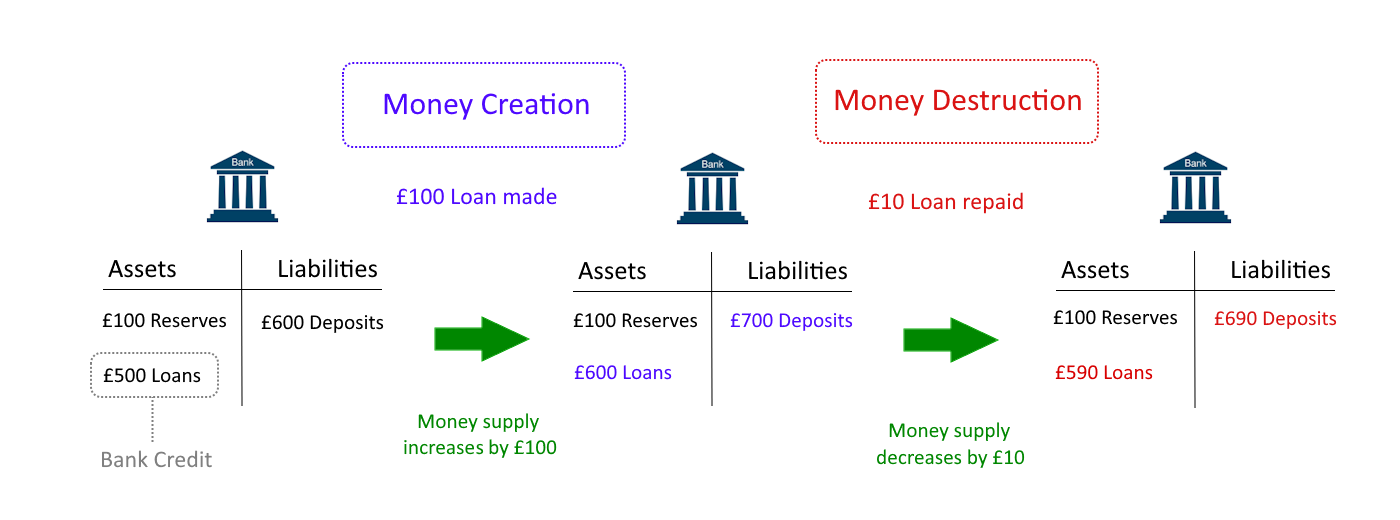

According to some, fiat money is now backed by debt because it is created from debt. When a bank lends it creates money and when a loan is paid back money is destroyed (according to the view). This is depicted in Figure 2 below for a single fictional bank issuing a new loan for £100, and receiving a £10 repayment afterwards.

Figure 2. Money Creation and Destruction According to Some*.

* For simplicity, everyone involved in the transactions are customers of the same bank. Interest is ignored.

The idea is that, when you spend your money, you are spending someone else's debt. The money the bank owes you, in the form of your deposit, also represents someone else's debt. Hence money is backed by debt, and debt is an IOU. The amount of money that can get created is limited by how much people and businesses are able to borrow.

Fiat Money is not Debt.

The problem with the above view though is that fiat money is not limited—as we know from countries that have hyperinflated their currencies. While your bank does hold a liability to you for the money in your account, the money it owes you is not a promise to deliver something else. Fiat money is unlimited, unbacked and not an IOU for anything.

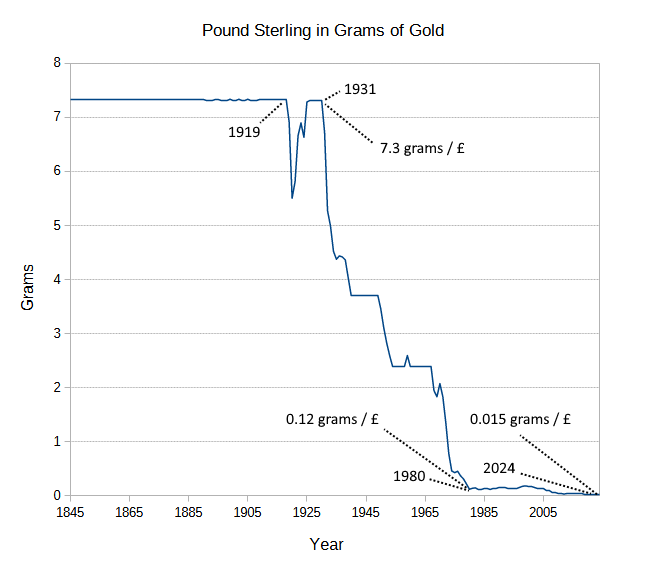

It's because of this that the UK government and Bank of England are able to debase the money and rob the public without restraint. Figure 3, below, shows that, since leaving the gold standard in 1931, the pound sterling has had 99.80% of its value stolen.

Figure 3. Sterling's Decline in Value as Measured in Gold.

During the 1980s and 1990s, the currency held on to what little value it had remaining. But this ended in the 2000s after the UK government and Bank of England decided to create fake economic growth by stoking a housing bubble, which is something that can only be achieved though currency debasement and the theft of people's savings.

When the housing bubble burst in 2007, the UK government and Bank of England decided to rob savers once again to rescue the housing bubble, ushering in a new era of endless currency debasement and fake economic growth funded by the continuous looting of the public's income and savings.

Discussion

So how does our current corrupt monetary system end? Let me know what you think by commenting on X or by emailing me. To comment or discuss, please reply to my X post containing the link to this article, or email me.