September 2024 Newsletter

September 2024 Newsletter

In this month's newsletter: UK's Phoney Economic Growth. See below or view the article in your browser.

Dear Readers,

For over a decade, the Bank of England has claimed the economy needs easy money as it embarked upon recklessly-loose monetary policies like ZIRP and QE. The opposite is, of course, true. The economy needs to rid itself of the easy-money addiction and cheap-debt mania. Instead, the easy money drug kept coming until the 2020 overdose.

Latest GDP figures show the UK economy has flatlined. This is despite the massive boost to the money supply from the 2020 overdose—something central bankers and other inflationists always claimed would stimulate the economy and boost economic growth.

The UK's Phoney Economy Explained

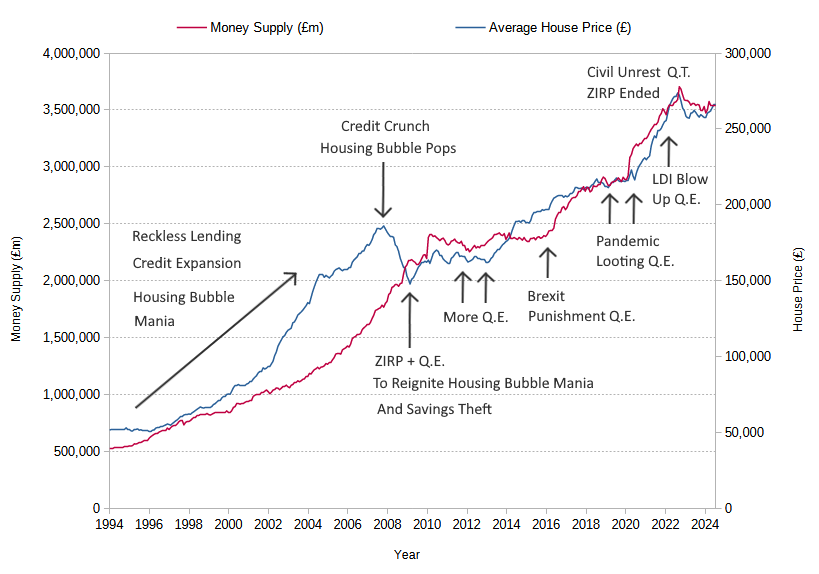

The reason there is little or no growth is because growth needs a productive economy. In the UK, the government and Bank of England try to pass off currency debasement as growth. The money is debased and the money supply inflated by encouraging people to borrow and pay more and more for houses, as shown in Figure 1, and the rate of debasement of the currency is understated—by selective sampling, which excludes house prices—to arrive at a fake growth figure.

Figure 1. Money Supply

(Bank of England)

vs

House Prices

(Nationwide)

over the last 30 years.

Genuine economic growth would increase the living standards of everyone in the UK as we produced more, prices fell and people had more. But since prices are not allowed to fall, and the price of houses (and other assets) must continuously rise regardless (as decided by the Bank of England), genuine economic growth is effectively not allowed. As a result, the average person's wages, savings and living standards are all being debased.

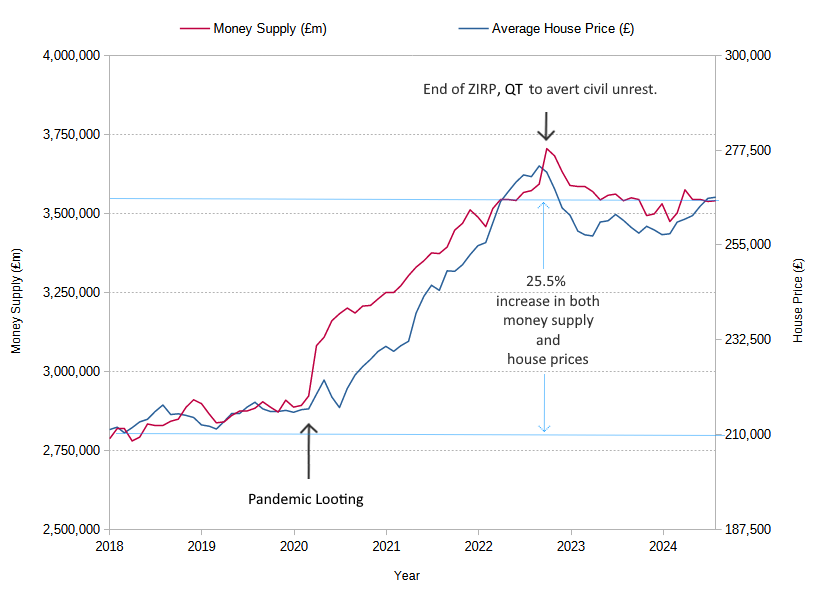

But even this phoney economy has now backfired on the Bank of England. The Bank stole so much during its pandemic looting, it had no choice but to reverse gears or risk civil unrest. As a result, both house prices and the money supply have contracted since ZIRP ended and QT (the unwinding of QE) started, as shown in Figure 2.

Figure 2. House Price Inflation and Money Supply Covering the Bank of England's Pandemic Looting.

To summarise, our GDP has flatlined since it is dependent on house price inflation, money supply expansion and currency debasement, instead of on the production of goods and services. A genuine productive economy would not see such a strong correlation between money supply and house prices.

Discussion

Let me know what you think by commenting on X or by emailing me. To comment or discuss, please reply to my X post containing the link to this article, or email me.