24 March 2020

Covid-19 pandemic

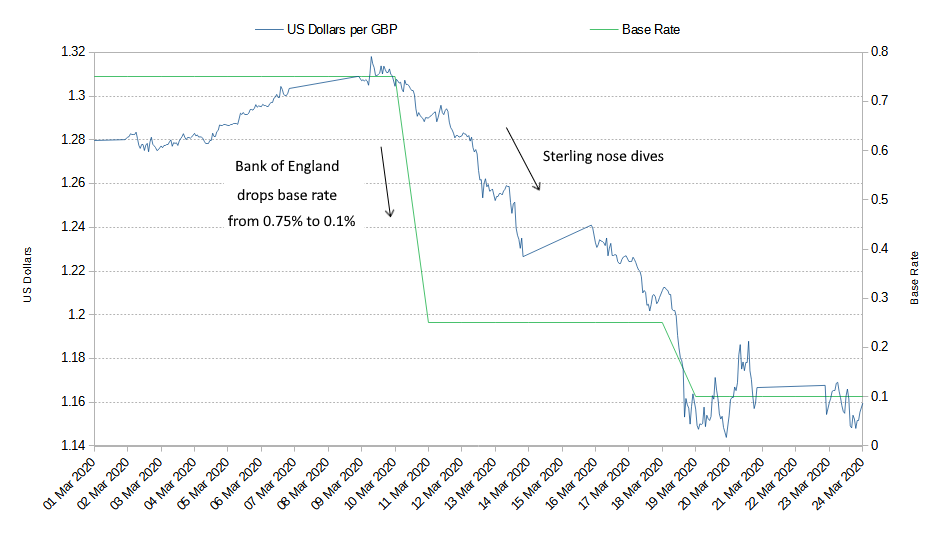

The Bank of England will never let a good crisis go to waste, and the Covid-19 pandemic was certainly one of them. As the UK government was shutting down huge swathes of the economy, the Bank of England took the opportunity to slash its base rate to 0.25% on the 11 March and further to 0.1% on the 19th March, double its counterfeiting, and hence guarantee much higher future inflation.

Sterling sank 11% against the US dollar over the following days, as shown in the chart below.

Data from

Yahoo Finance.

31 Dec 2021

Update

What followed was double digit inflation in house prices—a level not seen since the 2008 housing bubble—along with soaring producer price inflation eventually leading to the highest consumer price inflation in 30 years.

When an economy shrinks, because people are no longer working producing goods and services, the money supply has to shrink with it to keep prices stable. Without the supply of goods and services the existing money supply ends up bidding up prices.