The bank rate history

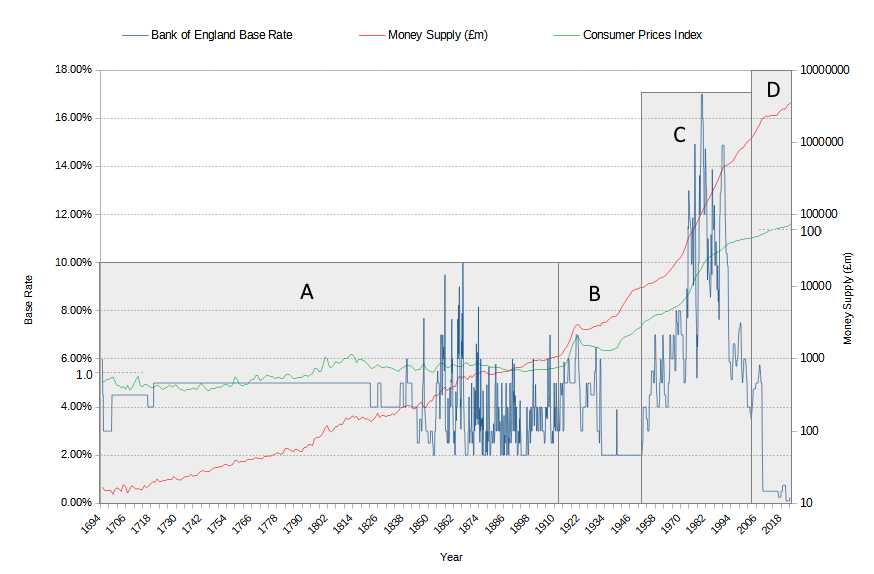

The Bank of England was established in 1694 to act as the English Government's banker. The chart below shows the base rate against the money supply and consumer prices (using the Consumer Prices Index) going back to 1694. The money supply and Consumer Prices Index are shown on logarithmic scales.

Bank of England Base Rate (long-term average is 4.7%), 31st of October 1694 to the 31st of December 2021.

Money supply data from the Bank of England

When the Bank of England was first established, the pound sterling was already in use as money. Originally a weight of silver, the pound sterling coinage had already been debased by 75%. Isacc Newton became Master of the Royal Mint soon after the bank was established to address issues of debasement and counterfeiting, inadvertantly putting the currency on a gold standard. The bank first offered an interest rate (now the base rate) of around 6%.

From funding government to debasing away war debt to financial repression

Until 1912 (period A), consumer prices remained relatively stable, ending the period at about the same as where they started. The average base rate over the period was 4.4% whilst the average yearly rise in consumer prices was a mere 0.23%.

After 1912, the gold standard was abandoned to allow the government to loot the money supply to fund world war one (Period B). After briefly returning to the gold standard in 1925, the UK abandoned the gold standard for good in 1931. What followed was the biggest rise in the money supply and consumer prices to date in the UK (Period C), with the base rate eventually peaking at 17% on 15th November 1979 as the Bank of England grappled to control the inflating money supply.

The Bank of England, being incapable of learning anything from its past mistakes, reduced base rates during the 1990s to help fuel the housing bubble that led to the financial crisis (Period D). Once the financial crisis hit, the bank rate was reduced in steps from 5% in October 2008 down to 0.5% on 5th March 2009, and a new era of financial repression began.