30 December 2021

Base rate raised

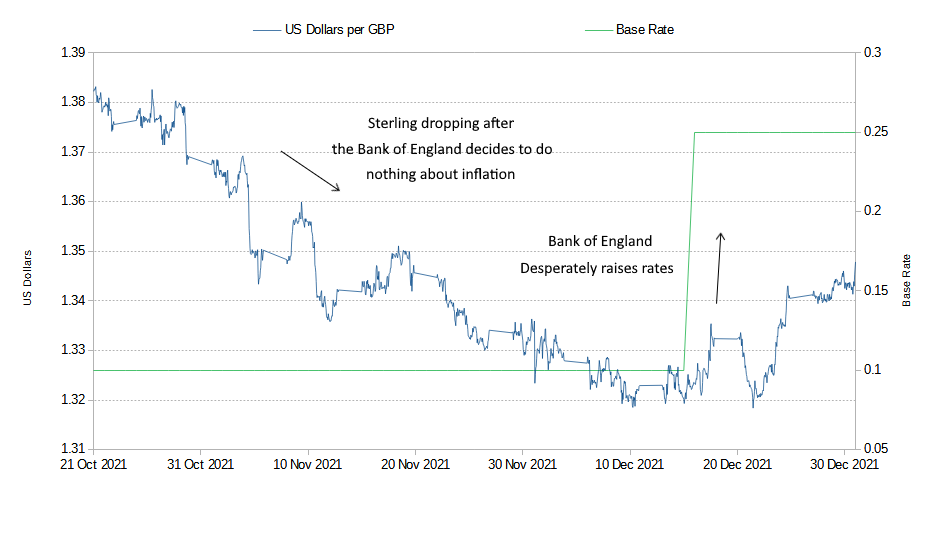

Having unleashed high inflation on the people of the United Kingdom, and even higher real inflation, the Bank of England raised its base rate on 16th December from a tiny 0.1% to a tiny 0.25%. This token gesture of a rate rise was in the context of their own inflation measure hitting 5.1%, producer price inflation hitting 9% and house price inflation hitting 13.4% in June and remaining above 10%.

Sterling against the US dollar December 2021. Data from

Yahoo Finance.

Sterling rose on the news and then fell back, but then rose again as Bank of England's chief economist, Huw Pill said more rate rises would be needed to tackle the inflation they created. It is unclear why the current rate rise was so tiny if the intention was to seriously tackle the inflation.