August 2024 Newsletter

August 2024 Newsletter

In this month's newsletter: Quantifying the Bank of England's Looting. See below or view the article in your browser.

Dear Readers,

At its meeting ending on 31 July 2024, the Bank of England decided to support its members' buy-to-let portfolios by reducing the bank rate to 5%. This was despite the rate of inflation only just dropping to the 2% arbitrary rate mandated by the UK government after reaching double-digits last year.

So already the bank has its eye on our hard-earned earnings and savings. There is clearly no end to the Bank of England's looting, but this raises the question: How much does the Bank of England actually steal from the public?

We can estimate the amount because the Bank of England publishes a breakdown of monetary aggregates (such as the amounts held in deposit accounts and interest-bearing accounts) in its Bankstats tables, and we know historical base rates and rates of inflation. Let's start by looking at the pandemic looting.

The Pandemic Looting

We will base our calculations on the data from table A6.1—Sectoral deposits and Divisia money. We will also calculate how much of the wealth stolen by the Bank of England has been transferred to mortgage debtors using data from table A5.3—Lending secured on dwellings. All data used are the non-seasonally adjusted.

The consumer prices index (CPI) is used to calculate the debasement of non-interest bearing deposits, whilst the financial repression rate (FRR) is used to calculate the debasement of interest-bearing deposits and mortgage balances. FRR is calculated as CPI less the Bank of England's base rate.

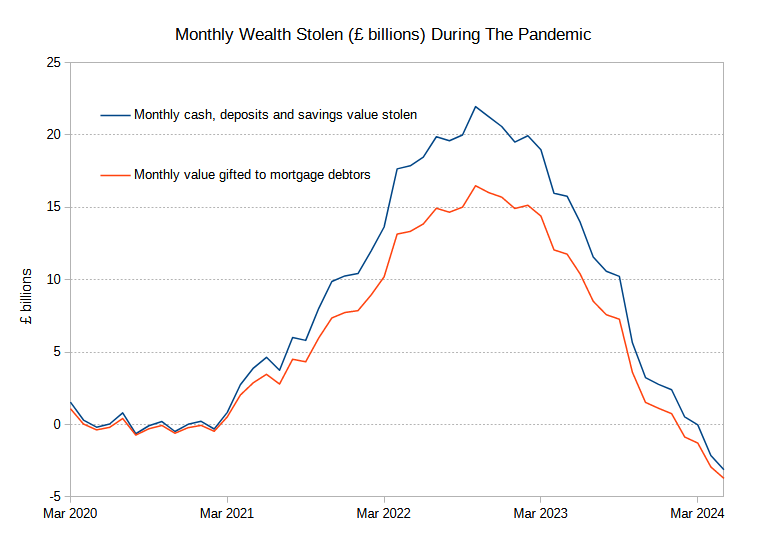

Figure 1, below, shows the monthly amounts stolen during the pandemic looting, which really took off in March 2021 peaking in October 2022 at £22bn per month. The amount gifted to mortgage debtors peaked at £15bn per month. The remaining was gifted to other debtors.

Figure 1. Monthly Wealth Stolen (£ billions) During The Pandemic.

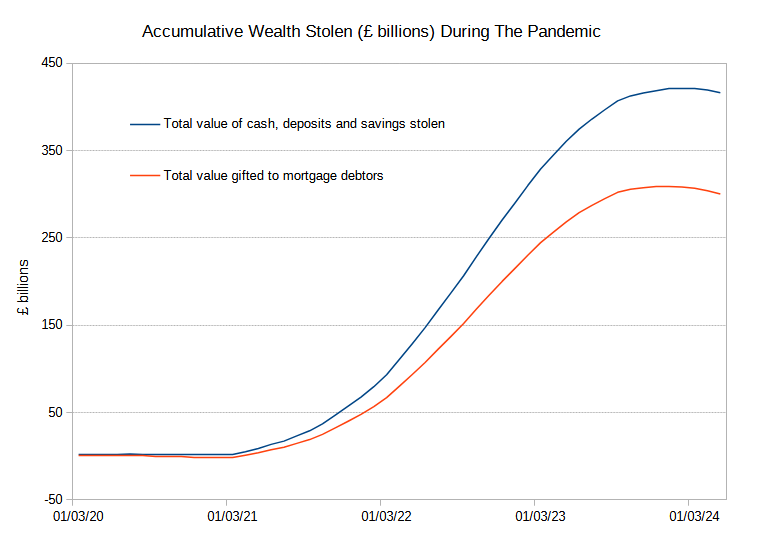

The total amount looted over the pandemic is shown in Figure 2. Incredibly, this peaked at £421bn in March 2024. It has since dropped very slightly after the Bank of England finally ended (for now at least) 15 years of impoverishing and harmful financial repression.

Figure 2. Accumulative Wealth Stolen (£ billions) During The Pandemic.

Coincidentally (or not) this figure is very similar to the £450bn of QE counterfeiting carried out by the bank using the pandemic as the excuse. The total amount of wealth gifted to mortgage debtors peaked 2 months earlier at £275bn.

Looting Since The Financial Crisis

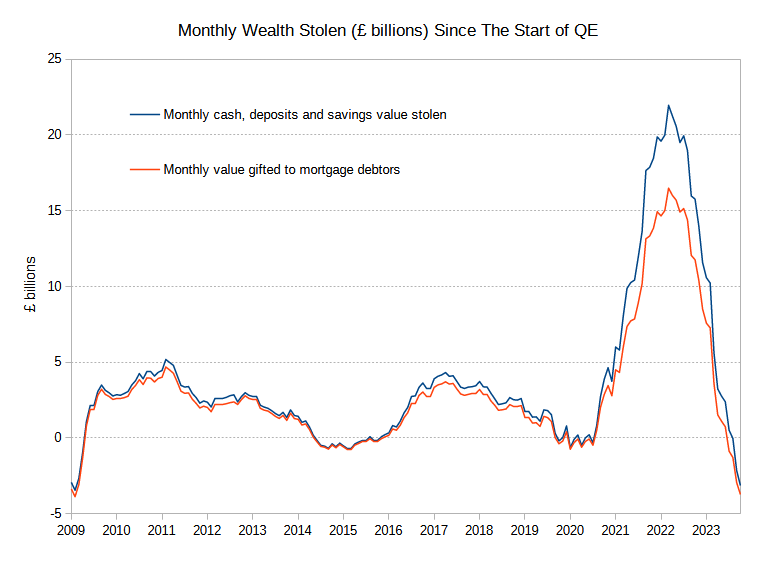

This begs the other question: how much has the Bank of England stolen since it embarked on QE back in March of 2009? Figure 3 shows the monthly amounts stolen since QE began.

Figure 3. Monthly Wealth Stolen (£ billions) Since The Start of QE.

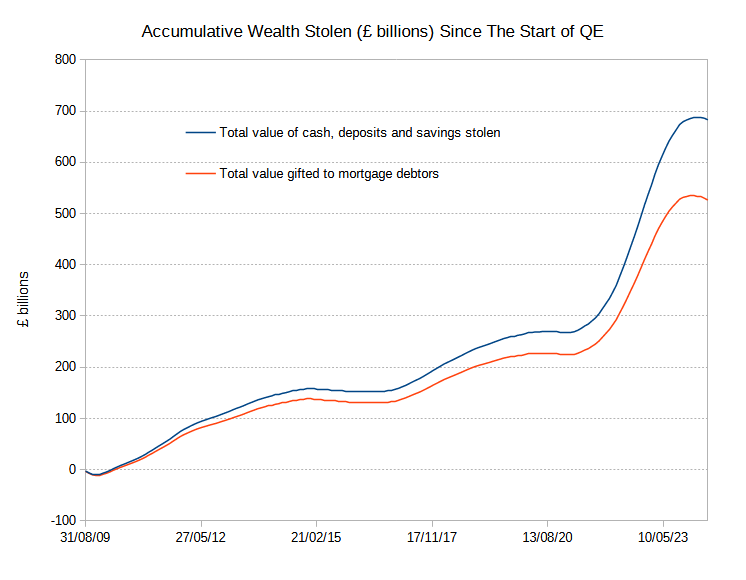

Figure 4 shows the total amount stolen since the beginning of QE. This peaked at £688bn with mortgage debtors receiving £486bn of that.

Figure 4. Accumulative Wealth Stolen (£ billions) Since The Start of QE.

Coincidentally again (or not) this figure is very similar to the £690bn of QE the Bank of England still has on its balance sheet, as shown in Figure 5 below.

Figure 5. Outstanding QE on the Bank of England's Balance Sheet as of 7 August 2024.

Conclusion

The amount of wealth stolen from the public and transferred to the wealthiest by the Bank of England during the pandemic was estimated to be £421bn. The amount stolen since the start of QE was estimated at £688bn. Although some may be able to claw a tiny fraction of that back now savings rates are above the rate of inflation, the bulk of that wealth has been stolen and transferred for good.

Discussion

The Bank of England likes to call it 'stimulus' and a 'wealth effect'. In reality, it is wealth transfer. The Bank of England cannot create wealth, but it does have the power to transfer wealth by debasing the currency, which is all it does and has been doing for decades.

Let me know what you think by commenting on X or by emailing me. To comment or discuss, please reply to my X post containing the link to this article, or email me.