July 2024 Newsletter

July 2024 Newsletter

In this month's newsletter: QE Has Led to Increased Inequality. See below or view the article in your browser.

Dear Readers,

It looks like Japan's central bank is finally impoverishing the Japanese by looting their savings as the Yen continues to collapse. On the bright side, MMTrs can no longer point to Japan as a model for money printing to fund government. On a brighter side, it could be an indication that central bank bubbles are on their last legs. Fingers crossed.

So as the people continue to believe their central banks are fighting inflation, the banks continue to create it, making most of them poorer whilst a few accumulate assets by borrowing the depreciating currency.

But apparently, we are all better off for it according to the Bank of England. Are we? Let's take a look.

QE Has Led to Increased Inequality

According to the Bank of England, Quantitative Easing (QE) has not increased inequality in the UK and has made us all better off. The reasoning being that, although QE increases the value of assets, it leads to more spending which creates jobs which leads to higher wages.

But is this true? What does 15 years of evidence say? And are we all better off since QE? The short answer is no. The longer answer is below.

Analysis

Whether QE has increased the value of assets will be addressed at the end. For the other claims, we will compare the data of the last 15 years with prior downturns and housing busts, starting with spending.

Spending

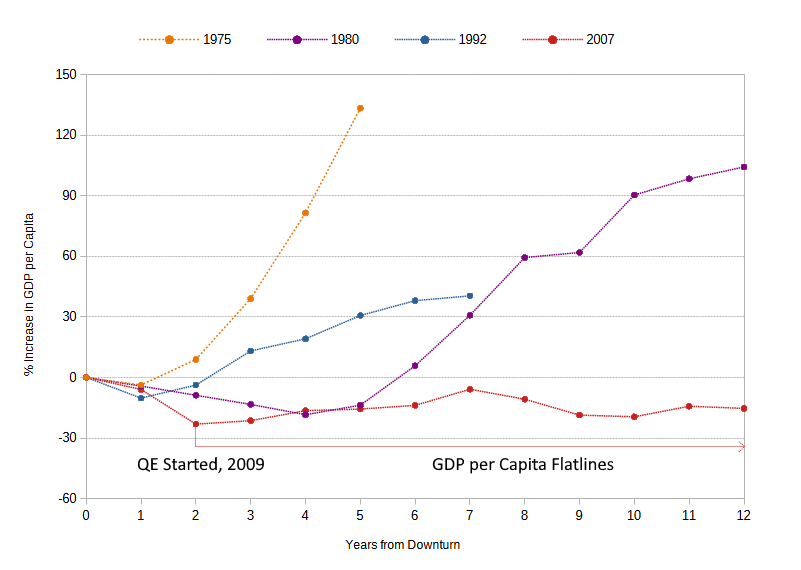

Figure 1, below, shows that QE did not lead to an increase in spending. In fact, GDP per capita recovered in all previous downturns except for the one where the Bank of England implemented QE.

Figure 1. GDP per Capita Following Downturns in the UK.

Wages

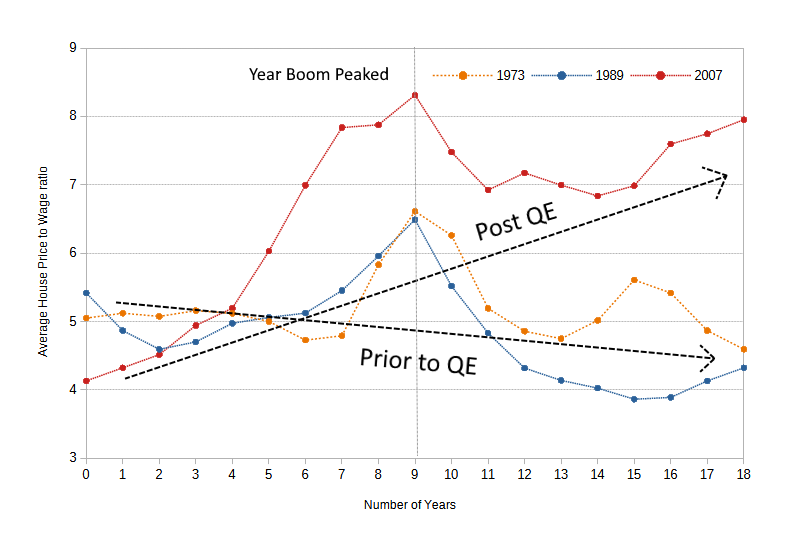

In prior housing busts, people ended up with more purchasing power after the bust was allowed to play out. Figure 2 shows that the only time wages lost house purchasing power after a bust was after the Bank of England implemented QE.

Figure 2. Average UK House Price to Wage.

Homeownership

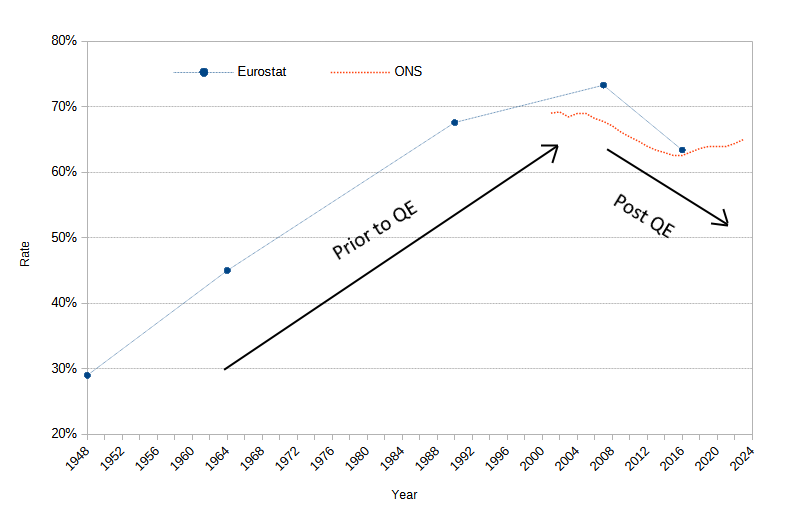

One of the most important measures of equality to people in the UK is homeownership. We can see from Figure 3 that, before QE, homeownership consistently increased following downturns and housing booms and busts. This changed following the Bank of England's QE where homeownership fell and never recovered.

Figure 3. UK Homeownership Rate.

Conclusion

The Bank of England is wrong in its claims that QE increases wealth, increases spending, creates jobs and increases wages—as the data shows. This is because QE does not increase the value of anything. It increases the price of things because that is what currency debasement does. It makes things more expensive (as well as robs savers).

Inflating asset prices by debasing a currency transfers purchasing power from the poorest to the wealthiest, depriving the former of the benefits of economic growth. This, hence, increases inequality.

Discussion

Money printing has never created wealth; it has only led to the impoverishment and destruction of nations, as thousands of years of history have already shown us.

Let me know what you think by commenting on X or by emailing me. To comment or discuss, please reply to my X post containing the link to this article, or email me.