May 2024 Newsletter

May 2024 Newsletter

In this month's newsletter: Update on the Boom & Bust Cycle. See below or view the article in your browser.

Dear Readers,

In recent years, economies have witnessed a resurgence of consumer price inflation due to ultra-reckless central bank monetary policies. In reality, though, central banks have been inflating since 2008. They have been robbing the people blind by debasing their money, with the proceeds ending up in the financial assets of the wealthiest.

In the UK, the Bank of England's currency debasement theft has pushed house prices to all time highs. The 2008 bust—the cure to the insane housing bubble—was denied by the Bank of England. But all the central bank really did was kick the can down the road until today and stave off the inevitable bust that will eventually come if it hasn't already started.

Update on the Boom & Bust Cycle

Anyone that lived through the 2008 global financial crisis knows what happened: lenders lent recklessly to anything with a pulse to chase up house prices. This created housing bubbles around the globe that inevitably burst. All this was encouraged by governments and their central banks.

As the bubbles popped, governments used their central banks to rob the public to make banks whole. Banks were labelled too big to fail; the public, there to be robbed.

Bust Suspended

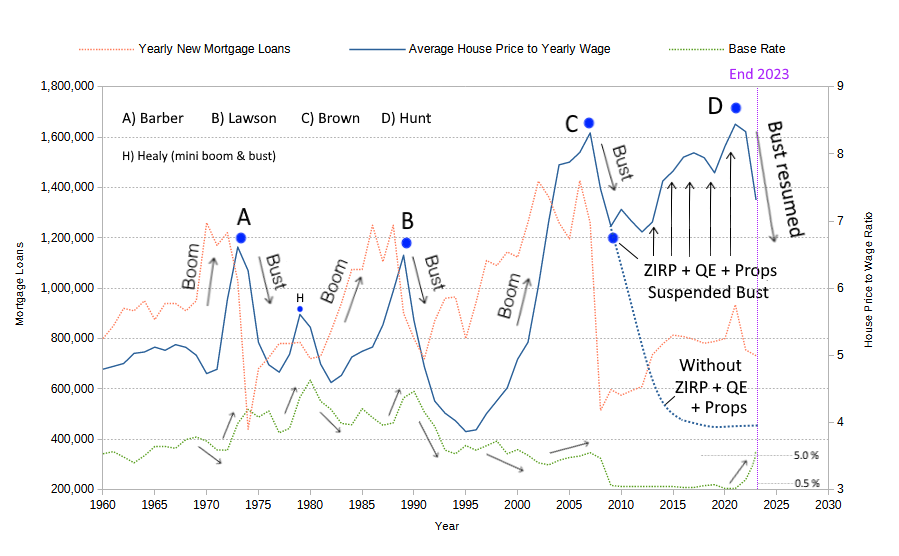

Keynesians talk of central banks smoothing out the business cycle, but in reality, what the Bank of England did with QE and ZIRP after 2008 was suspend the needed reversion to mean, break the housing market, and screw the frugal. Mortgage lending transactions never recovered. Instead, all lending went into sustaining insane prices, as shown in Figure 1 below.

Figure 1. UK Housing Booms and Busts since the 1970s*.

* Recent wage, house price and loan data are from the ONS, Nationwide BS and BSA.

Historical data are from Mark Boleat and the CBR.

Bust Resumed

The globally-synchronised 16-year looting by central banks may have pushed house prices to new highs, but it also created a whole new generation of lamebrains that believe they are paying high mortgage rates when, in fact, rates are low.

And the Bank of England cannot bail them out. It cannot lower rates or do QE without setting off fireworks in the bond market or causing inflation to take off. The bust that should have played out after 2008, and was halted and suspended by central bank plundering, has resumed. Without ZIRP and more QE, this monstrosity is coming down.

Discussion

To comment or discuss the content of this article, please reply to my Twitter/X post containing the link to this article, or email me.